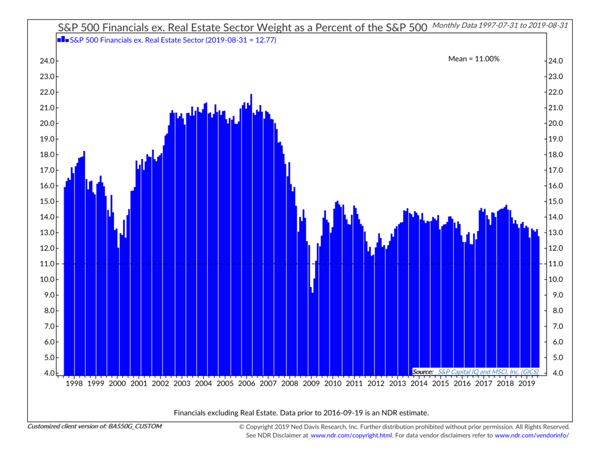

As value investors, one of the reasons we love investing in financials is because it has become an unloved segment of the market. Observe the following graph, which shows how the financial sector has shrank as an overall piece of the S&P 500 Index since the Global Financial Crisis:

S&P 500 Financials Sector (ex. Real Estate) as a Percentage of the S&P 500

7/31/1997 (Prospector Founding) to 8/31/2019

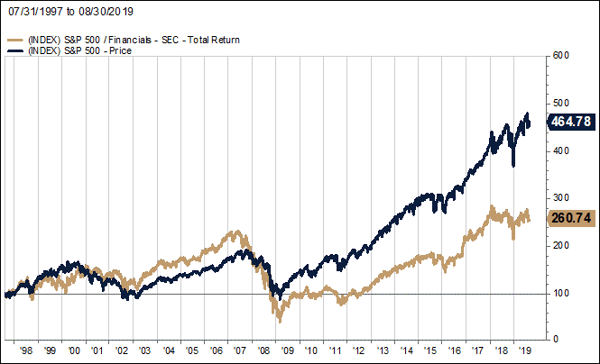

What used to be a 22% weighting in the index has hovered between 12% to 15% ever since. Financial stocks have dramatically underperformed other sectors during this economic cycle, especially growthier industries like information technology. The following chart shows the performance of financials versus the broad market.

S&P 500 Financials Sector vs. S&P 500 Index

7/31/1997 (Prospector Founding) to 8/30/2019

Source: FactSet

As investors have flocked to more “growthy” names like FAANG stocks (these five stocks and MSFT now account for nearly 20% of the S&P 500 Index, as illustrated in our recent blog), they have largely ignored financials.

For more information on what we look for in prospective investments throughout the Financials sector, we encourage to explore these two recent posts:

If you would like to be notified when we release new blogs, please let us know! Just complete the form below and we will deliver our insights to your inbox once per week.