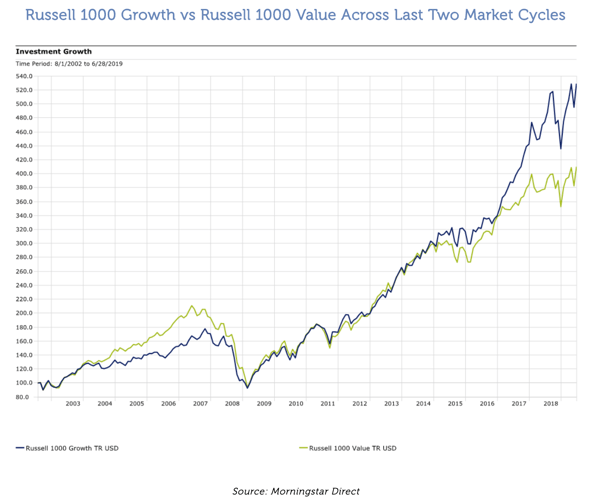

Last week, we discussed how value stocks have significantly underperformed growth stocks, and how broad market benchmarks such as the S&P 500 and the Russell 1000 have tilted further towards growth equities as a consequence of their market cap weighting methodology.

But all value investors are not the same. Here at Prospector we utilize two particular types of value investing techniques that can add value regardless of broader market conditions.

These two techniques are private market value (PMV) and free cash flow yield (FCF), and we are especially attracted to situations where we can use both at the same time.

Private Market Value (part 2, picking up where we left off last week):

The second type of PMV analysis we perform at Prospector is to transform a GAAP balance sheet into a statement of net asset value (NAV). Essentially, we mark a balance sheet to market using our own proprietary research into the carrying values as determined by management.

This is a crucial technique for analyzing balance sheet driven financial institutions such as lenders and insurers where half of the balance sheet is a “blind pool.” By that we mean that the stated values on the balance sheet for a loan portfolio in a lender or the claims reserves for an insurer are management estimates. In other words, management gets to grade their own exams over the short term. We try to identify managements whose estimates are consistently either conservative or optimistic over time.

One such example is a medical malpractice and workers comp insurer that we have recently purchased. Management, who we have long followed and admired, has consistently set reserves very conservatively over a long period of time – an important quality when dealing with such “long tail” insurance lines (where the ultimate cost of claims isn’t known until years after the business is written). While management’s history of conservatism could be relatively easily ascertained by most investors, we also take the extra step of manipulating the company’s statutory reserve data to try to get a rough estimate of how over-reserved the company currently is. We feel the company continues to have “equity in their reserves” and the valuation of the company does not fully reflect this position. Additionally, we view it as a potential m&a target. Our estimate of the company’s private market value, based on recent acquisitions of specialty insurance companies, as well as our view of its excess reserve position factored meaningfully in our decision to re-establish a long position in the stock.

Next week, we will elaborate on the second type of analysis we perform at Prospector: Free Cash Flow analysis, and provide our concluding answer to the question “Is value investing dead?”

If you would like to be notified when we release new insights, please let us know! Just complete the form on this page and we will deliver our content to your inbox once per week.