After a decade where the dramatic outperformance of growth stocks left many value investors scratching their heads, the recent rise in interest rates has poured cold water on high-flying tech stocks and helped swing the pendulum back to value stocks. In particular, the financial sector, which represents a relatively large portion of value indices, has been a key beneficiary of higher rates. Year to date through March 15, the Russell 3000 Value Index is outperforming the Russell 3000 Growth Index by nearly 11%.

Is the recent streak of value outperformance sustainable? First, let’s take a long-term perspective on the pure cyclicality of the relationship.

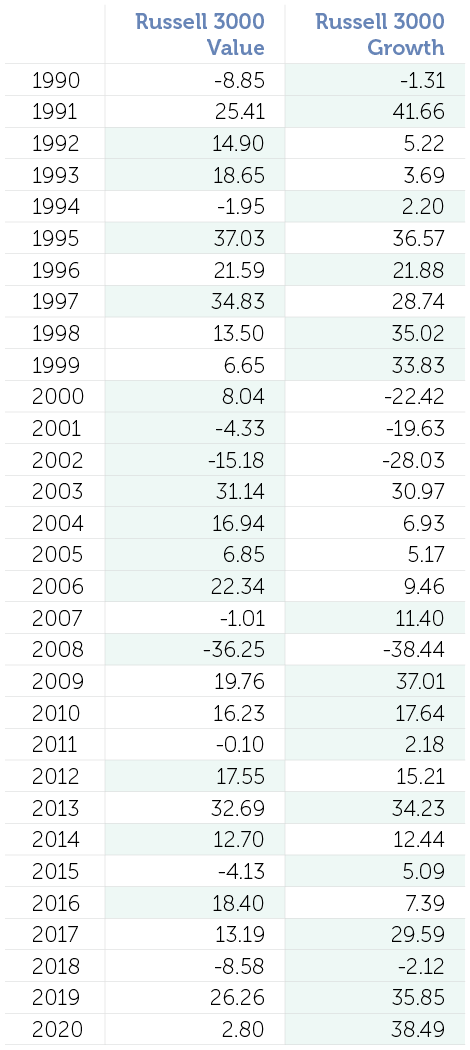

The table below displays the annual returns for the Russell 3000 Value Index and Russell 3000 Growth Index, with the outperformer highlighted in green. One can see that the first decade of this millennium was dominated by value stocks, beginning with the burst of the dot-com bubble and leading to a seven-year stretch of outperformance, from 2000-2006.

It’s important to remember that all sectors evolve, and companies mature. Eventually the largest internet-related companies today should see their earnings growth rates mature and valuations compress, and they will likely become value stocks.

Now, let’s get to the fun question: could we be headed into a period similar to 2000-2006?

While it’s unfair and far too premature to compare the recent selloff of tech stocks to the beginning of the dot-com bubble bursting in 1999/2000, there are some similarities. We discussed the exuberant investing atmosphere of 1999 in a recent blog we would encourage you to read: Reddit Traders and Things That Remind Us of the Dot-Com Bubble.

Another similarity is the upward movement in interest rates. The yield on the 10-year Treasury bond started 1999 around 4.7% and peaked around 6.7% in January of 2000. This placed pressure on unprofitable tech companies as their cost of capital increased. However, inflation was materially increasing in 1999 and the Fed was increasing the Federal Funds Rate as a result; three hikes in 1999 and three more in 2000.

While inflation remains stubbornly low today and the Fed has indicated rates will remain on hold, expectations for inflation have substantially increased, as shown by the recent selloff in the Treasury market, sending 10-year yields from 0.5% in August 2020 to 1.5% - 1.6% in mid-March 2021. This has dampened the outlook for tech stocks much like it did in 1999, while simultaneously benefitting financial companies.

Regardless of the specific catalyst, history has shown us that extended swings in either direction (value versus growth) are common, and it’s not entirely unrealistic to visualize investors in 2026 scratching their heads wondering when the outperformance of value stocks could end, just like they did in 2006.

Editor's Note (March 18, 2021): The post above is part of a white paper that was originally published in January 2021. You can download a copy of the full paper below.