Despite a rapid economic recovery, interest rates have stayed persistently low, and a market consensus has emerged that they will stay that way. But investors may be overlooking the outsized impact Fed asset purchases have had on rates, and what that could mean for the future.

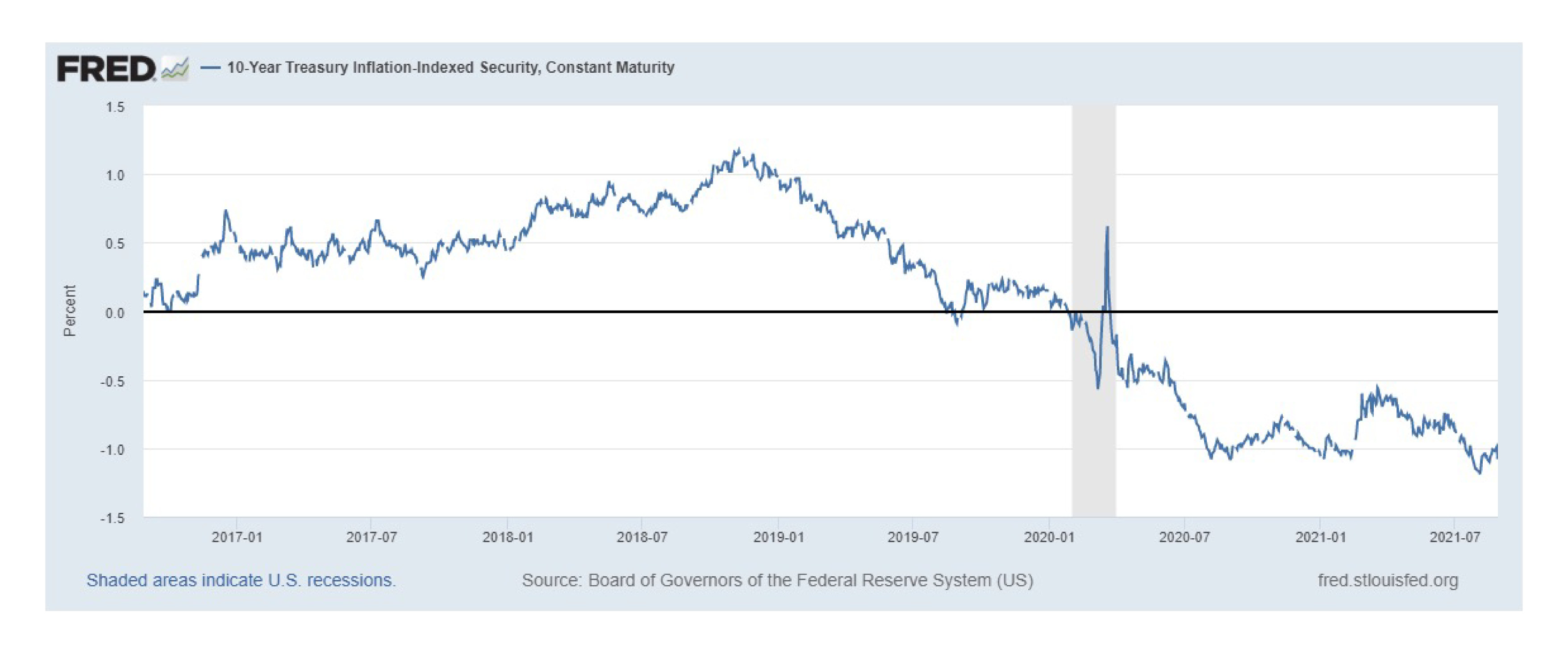

As the chart below shows, we’ve been in a persistently negative real rate environment since the beginning of the pandemic, despite the economic expansion. This is highly unusual.

The real yield of 10-year inflation protected securities has averaged about 25 basis points over longer periods, according to Mike Darda, of MKM Securities. He suggests the negative real rate environment may be partially the result of Fed asset purchases, and could thus lead to a rise in rates as asset purchases abate.

According to Darda, assuming inflation expectations of about 2% hold steady (recall, the Fed has indicated a willingness to allow inflation to go over 2% for a period), “that would mean the 10-year yield would climb to 2.3% or so.”

Adding some weight to this theory, JP Morgan recently noted, “…from the start of 2021 through May 2021, the Federal Reserve’s Treasury purchase of $80 billion per month has totaled $400 billion year to date, or roughly equal to the total net issuance of Treasury securities of $415 billion. As of May, the Fed held 24% of total Treasuries outstanding and up from 15% in February 2020 (pre-pandemic).”

Should the Fed begin to limit asset purchases, it seems plausible yields will rise in response.

Editor’s note: The blog above is an excerpt (lightly edited) from our Q2 client letter that was published in July 2021. We believe the information remains relevant at the time of publishing.