“The national debt is akin to student loans – while not an immediate concern, it could become a major problem.”

Consumer Debt

Last week, we discussed the state of the corporate leverage. Consumer debt is also an area of concern, but to a lesser extent than corporate debt. Domestic consumer debt is now $14 trillion – above levels realized prior to the financial crisis. However, real GDP has increased over 20% since then, which supports a higher debt level. Additionally, the credit profiles of consumers are stronger and subprime borrowings are at reasonable levels.

While the majority of consumer debt remains in the form of secured mortgages, the composition of the remaining has changed. Auto loans have grown disproportionately, nearly doubling to $1.2 trillion since post-crisis lows. Despite recent worries, credit quality has held up and lenders have tightened their standards. Also concerning is the growth in student debt which has tripled since 2007 to $1.6 trillion. While not an immediate concern, it is a long-term problem as debt incurred today restricts future growth. We have avoided consumer finance stocks given the inferior risk/reward dynamic. At this point in the cycle, we believe traditional banks are relatively attractive from an investment standpoint. These banks carry lower risk with upside potential based on the positive loan growth outlook, strong underlying credit quality, and attractive shareholder-return policies.

Another form of consumer leverage is margin debt. Today, it stands shy of $600 billion as compared to $450 billion at the start of the 2008 recession and over $400 billion at the height of the tech bubble. On a margin debt/GDP basis, we are in-line with peaks realized during the tech bubble and the year prior to the financial crisis. While margin debt/GDP has been elevated for a number of years, it remains an area of concern and will exacerbate market corrections as realized in the recent Q4 2018 sell-off.

Government Debt

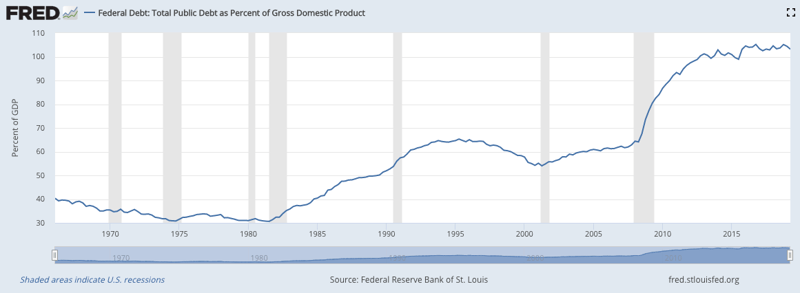

Today, national debt/GDP is 104% as compared to 63% in 2007 and projected to represent 144% of GDP by 2049. The national debt is akin to student loans – while not an immediate concern, it could become a major problem. The higher the debt burden, the greater the servicing costs which could otherwise be used for other expenditures. To illustrate the severity, if interest rates are one percentage point higher versus projections, the debt/GDP burden will reach 200% by 2049 (likewise if GDP growth undershoots projections). At this level, a combination of fiscal tightening, further debt issuance, and quantitative easing may be needed - which will likely have negative implications on the economy.

To put national debt in a global context, the United States is one of the most indebted nations in the G- 20. The only countries more indebted are Japan at 236% of GDP and Italy at 132% of GDP. Going forward, investors may shift allocations to less-indebted countries such as the United Kingdom, Canada, Australia, Germany, South Korea, China and, over the long term, to emerging economies such as India, Brazil, and Indonesia. This could result in higher national borrowing costs and a slower growth rate for the United States.

To read our blog from last week on corporate leverage, “A Discussion of the U.S. Debt Situation: Corporate Debt”, please click here.