"Now is always the most difficult time to invest."

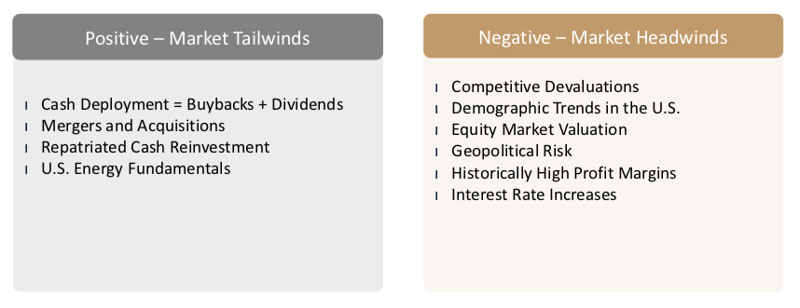

Lofty equity valuations, tight credit spreads, geopolitical risk and rising interest rates… investors these days have a lot to worry about. That’s why we believe a value approach with a sharp focus on maximizing risk adjusted returns makes as much sense today as it ever has.

At Prospector Partners, we pride ourselves on taking a conservative approach to equity investing. Our team members’ backgrounds in accounting, finance, and mathematics help contribute to our expertise in equity analysis. Focusing on balance sheets, seeking less-leveraged companies, strong free-cash flow generation and calculating private market values help us better control risk on a company-by-company basis regardless of overarching market conditions. Think of it as investing in equities from a credit perspective.

The large majority of our portfolio managers’ personal assets are invested alongside shareholders’ capital in our strategies, so we have strong incentives to limit the downside of our investments.

This blog will share thoughts around value investing, market tailwinds and headwinds, as well as ideas we are incorporating into portfolios to help our investors sleep well at night.

We’ll also be sharing:

- Lessons learned working alongside legendary value investors

- Data, graphs and takeaways to help you make investment decisions

- Insights on how to protect capital and amplify risk-adjusted returns

- Interviews with our team members

- Commentary around performance, positioning, and market outlook

Please let us know if you find this information helpful or have questions!

Sincerely,

The Prospector Partners Investment Team