The yield component of value stocks can play a valuable role in client portfolios given the lack of yield currently available from traditional fixed income asset classes as well as the interest rate (duration) risk associated with those types of securities.

The yield component is also an advantage of value stocks relative to growth stocks:

- The dividend yield (trailing 12 months) of the Russell 1000 Value Index was approximately 1.95% as of 2/26/2021.1

- This compares with a dividend yield of just 0.67% for the Russell 1000 Growth Index.2

- To put this into a broader context, even including the recent spike in Treasury yields, the yield to maturity for core bonds, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, was 1.55% as of 3/17/21 and the 10-year U.S. Treasury Bond yielded 1.63%.

Not only do value equity investors get higher income and the opportunity for superior capital appreciation, but they also limit duration risk. While certain equity sectors are relatively more susceptible to a rise in interest rates, fixed income investments typically possess far more duration risk and investors with heavy allocations in U.S. government bonds have likely experienced some pain thus far in 2021.

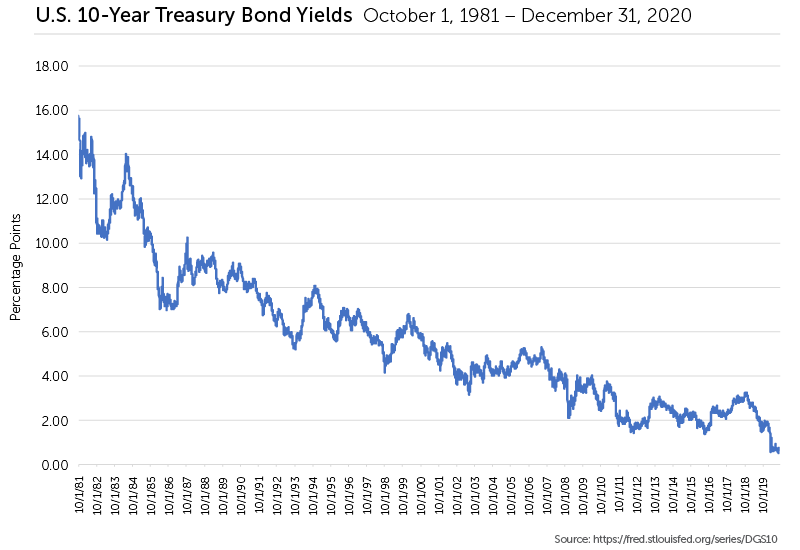

Furthermore, bonds have been in a 40-year bull market, as evidenced by the falling yields of U.S. Treasury bonds since 1980. With economic growth predicted to rebound sharply this year, potentially sparking inflation, there is potential for more downside in terms of rising yields and falling prices for bond investors. On the contrary, many equities, such as financial stocks, should benefit from rising rates and a steeper yield curve.

Interested in learning about 4 other powerful reasons to invest in value equities? Download our white paper, 5 Reasons to Invest in Value Equities, available below.

1https://www.ishares.com/us/products/239708/ishares-russell-1000-value-etf

2https://www.ishares.com/us/products/239706/ishares-russell-1000-growth-etf