The market seemed to grapple with a "higher for longer" interest rate environment in the third quarter. The benchmark 10-year Treasury rose significantly (from 3.81% to 4.57%), causing unease for investors, and contributing to the market’s decline during the period. Given the sharp rise in interest rates, sectors which traditionally carry higher dividend yields and/or higher levels of debt were hit hardest. This included utilities, real estate, and consumer staples stocks.

Inflation, while continuing to print lower year over year increases, remained persistently above the Federal Reserve’s 2% target. Indeed, recent core inflation readings remain closer to 4%. Meanwhile, the U.S. consumer remains resilient, and spending continues at fairly robust levels, resulting in recession forecasts being pushed ever farther into the distance.

Consumer Behavior Shifts: From Brand Choices to Credit Concerns

That said, there are underlying signs of consumers pulling back – especially the low-end consumer. Retailers have noted customers trading down to private label brands, or smaller pack sizes for example. Additionally, banks and other companies with finance arms have noted credit trends are beginning to “normalize” from ultra-low levels aided by pandemic-related stimulus. Indicative of this, Macy's stock was hit hard in August when they announced a concerning rise in credit card delinquencies.

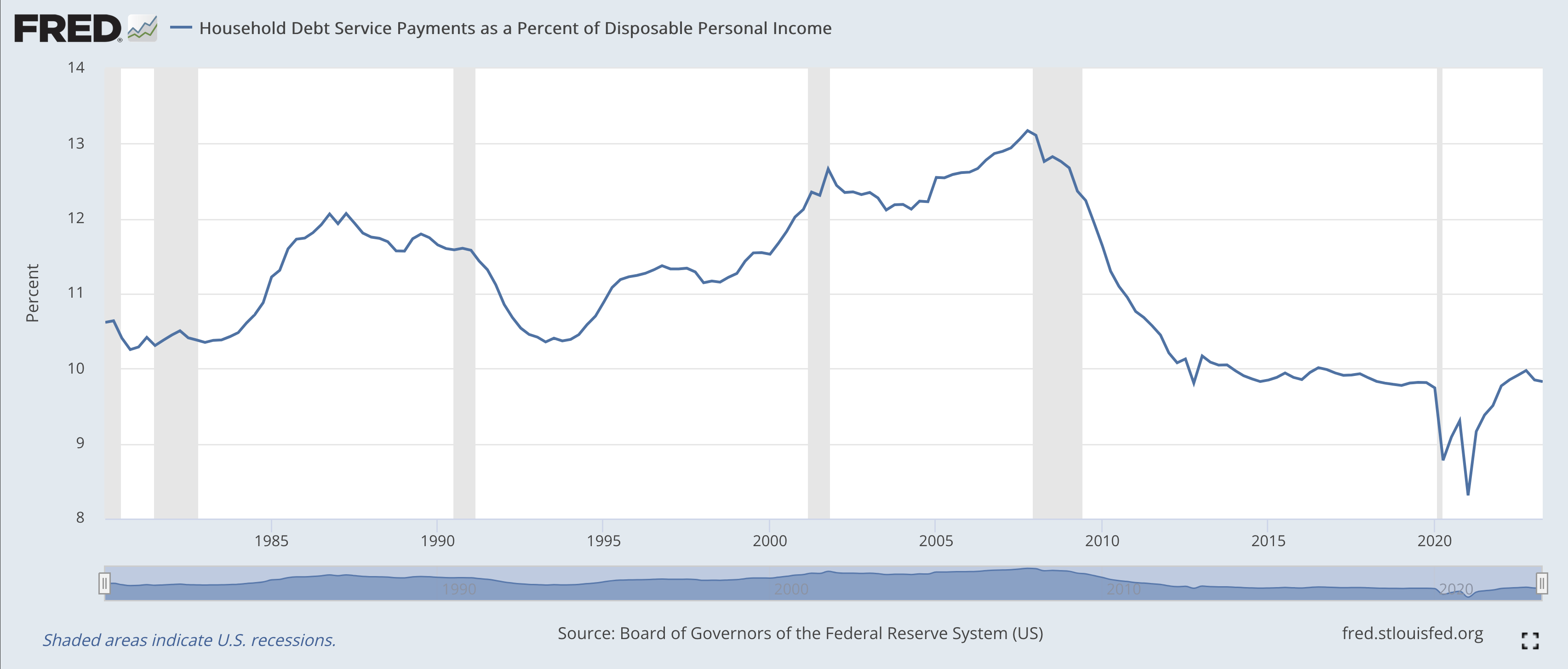

Clearly, impacts are starting to be felt from the drying up of pandemic-related excess savings. However, as can be seen in the chart below, consumer balance sheets remain relatively healthy, and overall debt service payments, for the time being, remain low relative to history.

Over time, the historic rise in interest rates could further strain the consumer. Currently, most homeowners hold mortgages with a rate below 4% (to be specific, 72% of borrowers locked in below 4% according to Goldman Sachs). This is contributing to the current logjam in the housing market, as the prospect of a mortgage closer to 8% is daunting. Over time, though, life changes often necessitate moves, and resultant mortgages will require higher debt service payments. Auto loans have followed a similar path, rising from 5.5% last summer to almost 8.5% in just over a year (for a 48 month term).

Rising Term Premiums Contributing to Higher-For-Longer Interest Rates

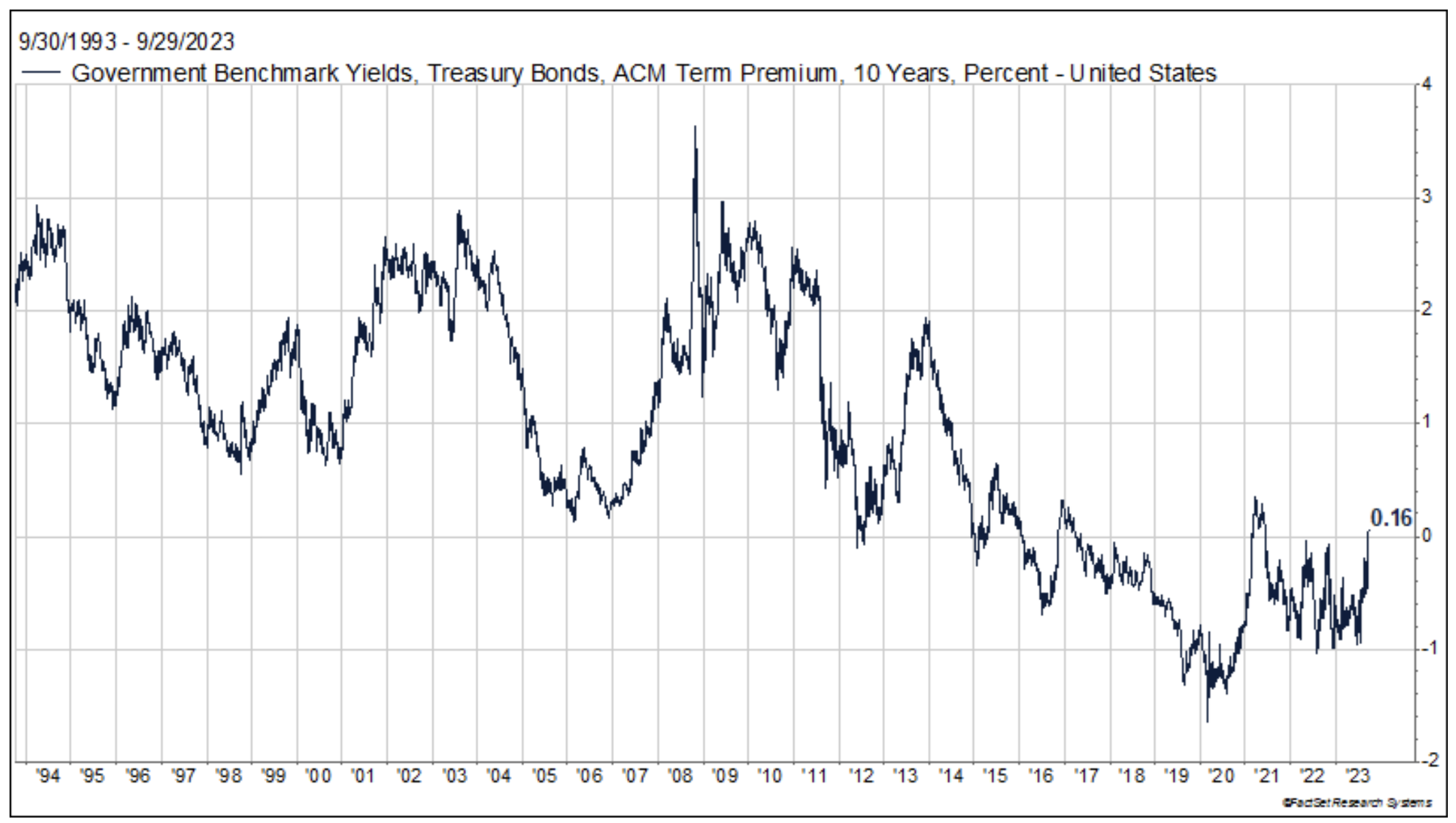

In addition to the stronger-than-expected economy and persistently high inflation, market followers and pundits have recently become concerned with the concept of "term premium" and the potential for rising term premiums to be a contributing factor to a higher-for-longer interest rate environment. The term premium, which is the extra yield investors demand to compensate for risks implicit in buying a longer-term bond, has recently turned positive after spending the better part of the past five years in negative territory. However, as shown in the chart below, the term premium on the 10-year Treasury has historically been significantly higher for long periods at a time. In fact, according to the Wall Street Journal, the term premium has added an average 1.5% to 10–year yields since 1961.

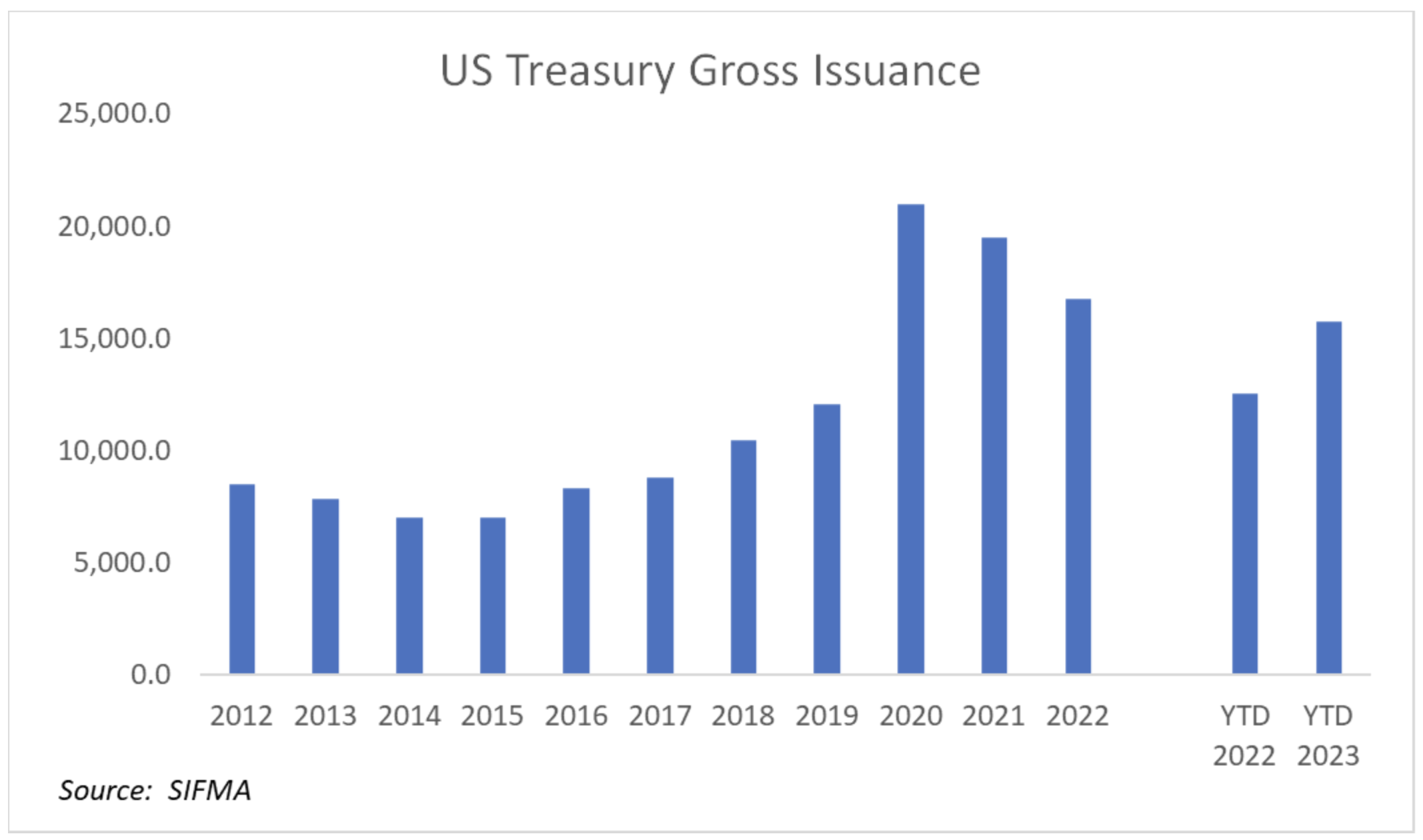

It is, of course, difficult to determine what exactly has caused the term premium on long-term bonds to increase. One reasonable explanation, given the higher interest rate backdrop, is concerns about the rising level of federal debt and deficit funding. As shown in the chart below, the U.S. government has issued $15.7 trillion in bonds through September, up from $12.5 trillion through the same point last year and on track to reach the record levels seen in 2020. Issuances are anticipated to increase a further 23% in 2024, according to Barron’s.

Could rising deficits, and ever-increasing levels of U.S. debt finally matter to fixed income investors? Only time will tell; but, if term premiums continue to rise, interest rates could head even higher from here.