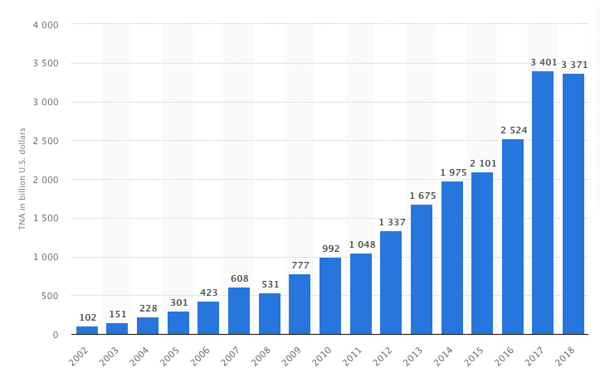

Asset flows into exchange-traded funds (ETFs) over the past twenty years have been staggering, especially during the post-2008 period. In November of this year, U.S.-based exchange-traded funds surpassed a record $4 trillion in assets1. The graph below illustrates the dramatic growth:

Total net assets of Exchange Traded Funds (ETFs) in the United States from 2002 to 2018

Source: Statista.com

One area that has seen particular interest over the past few years has been high-dividend ETFs. Investors, realizing the late innings of the economic cycle, have gained appreciation for the lower beta nature of dividend-paying stocks. These vehicles can provide equity exposure with the promise of upside participation and potentially limited downside. High-dividend ETFs also provide a level of income that can help make up for the low yield found in bond funds today.

As value investors, many of the companies in our investable universe pay out dividends. We regard a dollar of dividends as equivalent to a dollar of price appreciation. Having said that, if a company pays a substantial dividend, it provides a nice cushion, which we like to see. On the other hand, given the significant amounts of dividend cuts that we saw during the Global Financial Crisis, a singular focus on dividends can be a flawed strategy. When analyzing a dividend paying company, you should look at the consistency of their cash flow generation and their ability to generate net cash flow in the future and evaluate it very carefully.

There are many companies that are paying out a substantial portion of their operating earnings, indicating some risks, so an over reliance on a high dividend paying strategy is not one that we would necessarily endorse. We do like to see capital returned to shareholders, but we’re always evaluating what the payout ratios are and analyzing the dividend policy in the context of the broader capital management strategy. So, dividends alone aren’t something that we believe investors should focus on. We also believe that given current and future legislation, dividend tax rates are likely to rise.

1 https://www.cnbc.com/2019/11/09/etf-assets-rise-to-a-record-4-trillion-and-its-still-early-days.html