In the lead-up to 2008, securities known as collateralized debt obligations (CDOs) and collateralized mortgage obligations (CMOs) held large amounts of risky mortgages and were direct contributors to the credit crisis that ensued. While mortgage lending standards have improved considerably since then and CDOs/CMOs are not of particular concern, other areas of today’s debt market have expanded significantly in size and are worth keeping an eye on.

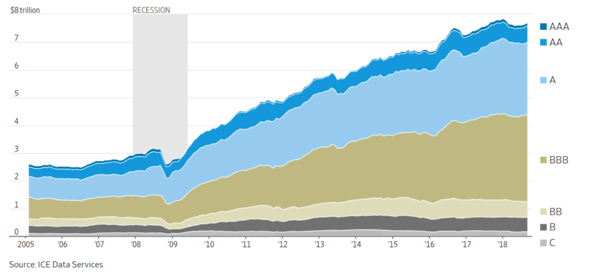

Specifically, levels of U.S. corporate debt have increased dramatically since pre-crisis levels, as illustrated by the graph below. The BBB-rated market, for example, is five times larger today than in 2007.

Value of U.S. Corporate Bonds by Rating

2005-2019

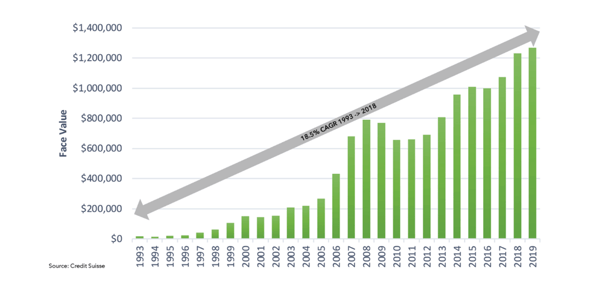

Along with the rise in corporate bond issuance has been a steady increase in another similar asset class: bank loans. Also known as leveraged loans, the bank loan market is currently valued at over $1 trillion. The growth in the loan market has mirrored the growth in the corporate debt market as shown below.

Size and Growth of the Bank Loan Market

1993-2019

Banks used to be the largest holders of these loans, but other types of investors have been drawn to their floating-rate nature as well as their senior position in a company’s capital structure. These investors include institutional money managers and collateralized loan obligations, or CLOs.

CLOs serve an important role as a source of financing for U.S. corporations, making credit more available to thousands of corporate borrowers that may be holding high levels of debt, or those rated below-investment grade (BBB). CLOs provide 50-65% percent of funding for these companies, according to the Structured Finance Association (SFA).1

While the rise of corporate debt levels and the bundling of relatively lower-rated corporate loans sounds like a foreboding combination, there are meaningful differences between CLOs and the CDOs/CMOs that played a large role in the Global Financial Crisis. According to the SFA’s February 2020 report:

“Although a severe economic downturn may result in meaningful CLO deterioration, we posit that there are several structural mitigants that limit the impact on the broader economy. Today’s CLOs lack the synthetic exposure and “re-securitization” structures of past CDOs which were backed by the subordinate bonds of other CDOs or other securitized bonds like subprime RMBS, CMBS and CDOs (e.g., “CDO-squared”). These synthetic CDOs and CDO squared structures – mainly backed by mortgage risk pre-crisis – amplified correlation and credit risk and made these earlier CDOs more susceptible to catastrophic loss. Moreover, the maturities of CLOs liabilities are matched to underlying assets and CLOs do not mark-to-market their loans which protects the CLO market valuation even as the underlying market declines. As noted by Federal Reserve Chairman Powell “while CLOs have facilitated the growth of leveraged loans, many have stable funding: Investors commit funds for lengthy periods, so they cannot, through withdrawals, force CLOs to sell assets at distressed prices.” 2

Currently, we believe the growth of the BBB-rated corporate bond market warrants more concern than CLOs. Post the 2001 recession, 15% of BBB issuers realized downgrades to high-yield status in the following three years. In 2008, that figure was 11%. However, in both recessions, over 40% of issuers were labeled as having the potential of being downgraded to high yield. The next recession, whenever it occurs, could be more material for BBB issuers given the staggering growth of debt versus prior cycles, and the higher weighting of BBB-minus within the cohort. If these BBB-minus bonds are downgraded just one notch, the issuers will be considered “high yield.” This will result in materially higher borrowing costs, increased investor scrutiny, reduced access to the credit markets, and (all else being equal) lower net earnings.

Interested in learning more? Join the PMs of Prospector, John Gillespie, Kevin O’Brien (CFA), and Jason Kish (CPA, CFA) for a conference call on Tuesday, February 25 @ 2pm ET where we will be discussing the risks associated with the rise in corporate debt as well as other aspects of today’s market. Click here or on the image below to register.

1,2https://structuredfinance.org/wp-content/uploads/2020/02/SFA-CLO-White-Paper.pdf