Between early 2022 and mid-2023, as the Federal Reserve aggressively raised interest rates in an effort to lower inflation, it caused significant uncertainty within stock and bond markets.

Today, although the rate of inflation has subsided and the consensus appears to be that we have reached an end to the Fed hiking cycle, we believe declaring victory is premature.

The U.S. and rest of the world continue to manage the lingering impacts of excessively elevated prices and higher interest rates while contending with geopolitical upheaval. In our assessment, the possibility of a policy error by the Fed and/or a recession remains high. Although, barring extraneous events, we still lean towards the likelihood of an economic slowdown, not a recession.

Perhaps the biggest present risk would seem to be from a shock to the system during this period of relative weakness while the transition from the pandemic economy to a more normalized economy advances.

Certainly, the traumatic events in Israel and the risk of further disruption spreading from the Middle East in the months to come keep us up at night—as we are sure they do you as well. As always, with our bias towards quality, we strive to mitigate any potential downside in our portfolios, while also participating in the upside.

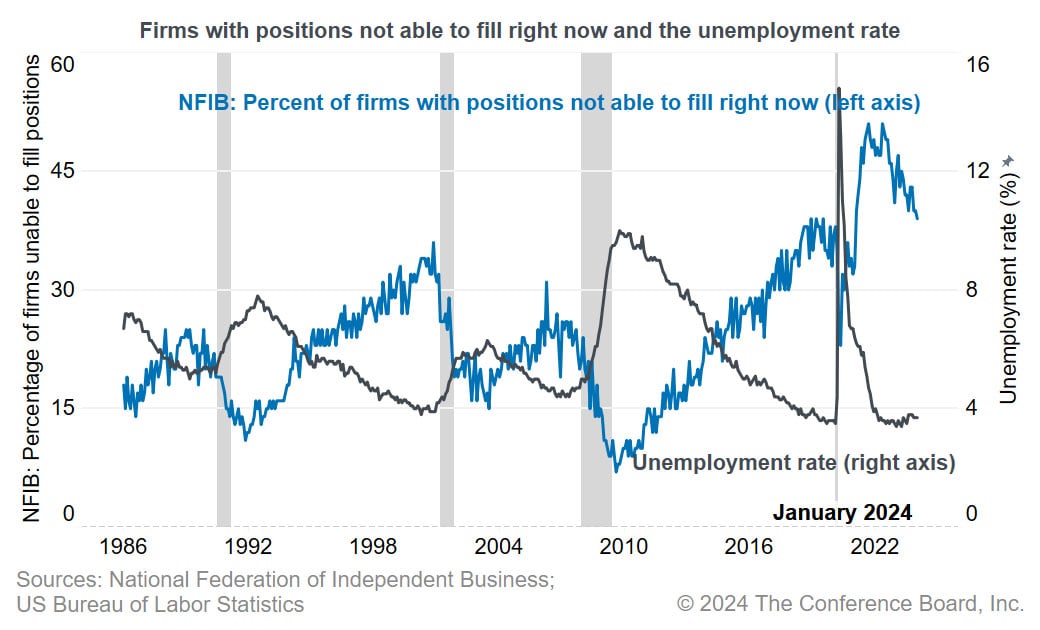

Job Market Strength Likely to Endure

On a positive note, U.S. employment fundamentals remain strong and we believe pieces are in place for that to continue.

Heavy fiscal stimulus from already passed federal legislation for defense, infrastructure, semiconductors, and energy investments are only now beginning to be awarded to companies. The spending will not peak until later in the decade.

Meanwhile, relatively high energy costs in Europe, and Germany in particular, help make domestic manufacturing relatively more attractive. Growing political risks have made China less business friendly.

All told, U.S. manufacturing is being called upon to step up.

Barring a major crisis, “anyone who’s willing to work,” as Ronald Reagan put it, should be able to find a job. And pay their bills.

Source: The Conference Board

Furthermore, supply/demand imbalances in the labor market suggest further wage gains to come, which will partially mitigate the impact of inflation on the consumer.

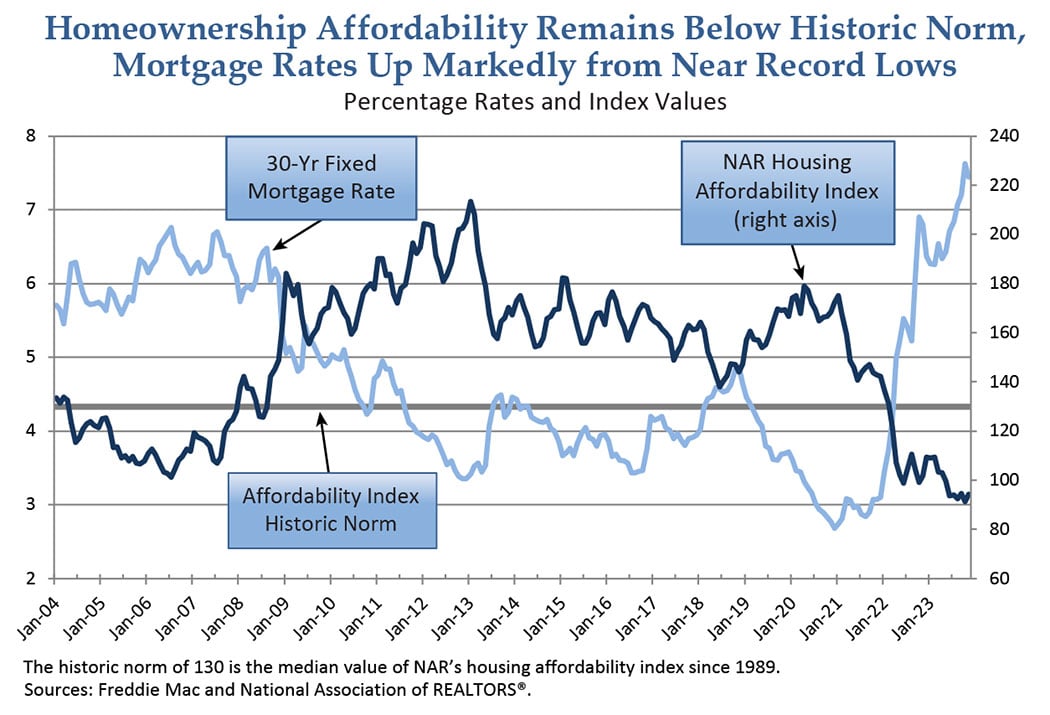

Housing Market Stressed but Stable

Turning to another prominent driver of the economy, we expect continued housing market pressures as a result of higher interest rates and affordability concerns.

Source: U.S. Department of Housing and Urban Development

However, the shortage of housing after a decade-plus of underinvestment following the Great Financial Crisis should prevent a disastrous decline in home prices.

Lower-income consumers have been most impacted by the current inflationary environment, but consumer balance sheets remain generally healthy for the majority of Americans, and consumer credit quality remains strong at the moment.

Cautious, but not Gloomy

Assessing the present landscape, we can understand the stress resulting from the highest inflation and interest rate combination we’ve seen in the past 10 years.

Yet, we do not believe it supports an argument for a recession.

Nonetheless, the unexpected can occur. Although should a recession happen in the near term, the factors highlighted above suggest it could be less significant than the previous two recessionary periods.

We are also mindful that 2024 is an election year, the result of which could have implications on companies, sectors, and the overall economy.

Given all of these factors, and following years of ever-higher growth stock valuations driven in part by lower interest rates, we believe value investing is ripe for a period of outperformance.

We continue to find opportunities to invest in quality businesses that, despite solid balance sheets and cash flows, trade at levels that have detached from our assessment of the fundamentals.