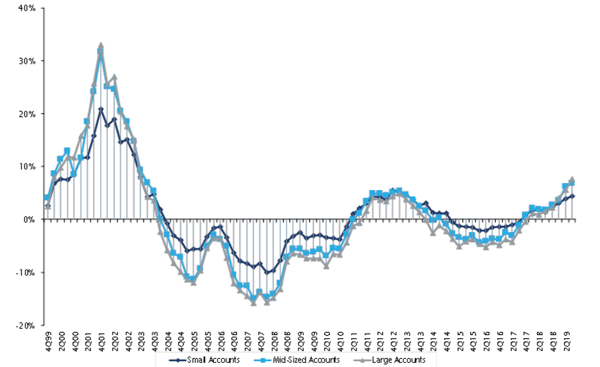

The property-casualty industry is cyclical – a function of insurers being unable to know their cost of goods sold (i.e. claims) until well after the policies were incepted. One can see in the chart below where we are in the cycle1.

Average Commercial Premium Rate Change, by Account Size

Chart prepared by Barclays Research

We are not surprised to see insurance industry pricing improve, as we have witnessed important developments in the sector the last couple of years. Specifically, the following issues have collectively created the need for premium increases:

- 2017 was a record year for losses from catastrophes, followed by another above-average year in 2018.

- Several significant market-share leaders have decided to remediate their challenged books of business, which has withdrawn capacity in many lines of insurance.

- Interest rates remain at historically low levels, which limits the amount of investment income insurance companies can earn on the premiums they collect (and investment income exceeds underwriting income for many insurers).

- The emergence of “social inflation” (greater attorney involvement in claims, higher jury awards, etc.) has brought much concern to the expected profitability of business (a similar environment led to the price increases seen on the chart in 2000-2001, before the losses related to the events of 9-11 caused rates to skyrocket).

We have witnessed some volatility in reported results of insurance companies, as managements recognize these factors in their income statements and balance sheets and become more conservative in establishing loss reserves. Stock performance in this sector has lagged in recent months, due in part to this phenomenon.

Long term, we are incrementally more constructive on the sector. Loss inflation leads to price increases, which leads to industry growth and ultimately improved underwriting results and aggregate returns on equity. We strive to invest in insurance companies that we believe are better positioned from a balance sheet perspective, with our bottom-up, internal reserve analysis featuring prominently in our decision-making process.

To learn more about how we invest in insurance companies, we encourage you to explore this blog, Balance Sheet Detectives - How We Analyze Insurance Companies or download our research paper below, Statutory Data: A Look Under the Hood of an Insurance Company.

1 Chart provided by the Council of Insurance Agents and Brokers