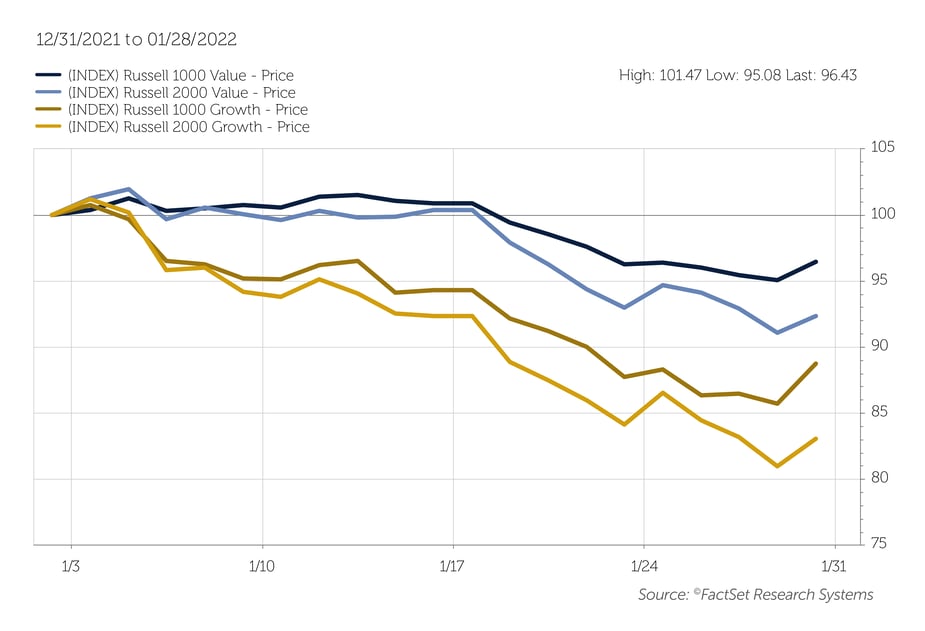

It’s only a month, but value stocks have significantly outperformed growth out of the gate in 2022. While we won’t try to make a call on whether this is a long-term rotation, we don’t find the outperformance surprising, and see a few reasons why it could continue.

The argument for value starts with inflation, which hit 7% annually in December, the highest level in 40 years. With rising inflation comes higher interest rates, and that doesn’t augur well for the valuations of growth stocks, whose future earnings start to get discounted at higher rates.

Just how much rising rates affect growth stocks is up for debate, but a recent Institutional Investor article referenced a study from InvestmentMetrics that estimates value stocks would outperform growth stocks by 100 basis points for every 10% rise in interest rates.

Another reason value stocks should outperform in an inflationary environment: Value indices are more heavily weighted to cyclical sectors that would benefit from an inflationary environment. The financial sector — an area of focus for Prospector — could be a key beneficiary as rising rates boost to bank earnings.

Readers of our blog know we have been discussing the threat of inflation for some time now. But after a year of rising prices, and the Federal Reserve acknowledging the risk has grown, investors may want to make sure their portfolio is positioned for it.