Have you ever been researching a stock and noticed that it has no P/E ratio? This is usually because the company is unprofitable and thus has no earnings to use as the denominator within the ratio. Current examples of well-known companies with no earnings include Snap (maker of Snapchat), Uber, Lyft, Zillow and Wayfair, among many others. These growth companies are often foregoing near-term earnings in order to reinvest back into their businesses and scale their earnings potential.

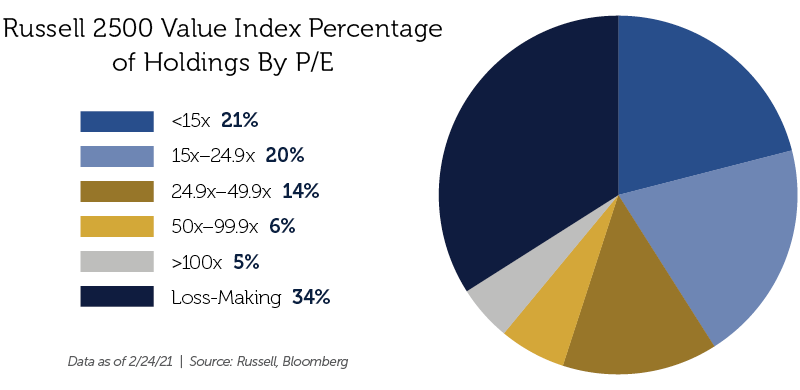

Seeing unprofitable companies within growth indices makes sense, but what you may find surprising is the number of unprofitable companies in value indices. For example, one particular value index we have been monitoring is the Russell 2500 Value Index, given its small-to-mid cap nature which is an area we like to invest in.

As you can see in the chart above, 34% of the Index’s holdings, or nearly 660 of the 1,911 companies in the Index, are currently generating losses. 660 companies! This doesn’t exactly sync with the commonly held view that value stocks are usually mature companies that are returning value (or at least capable of returning value) to shareholders.

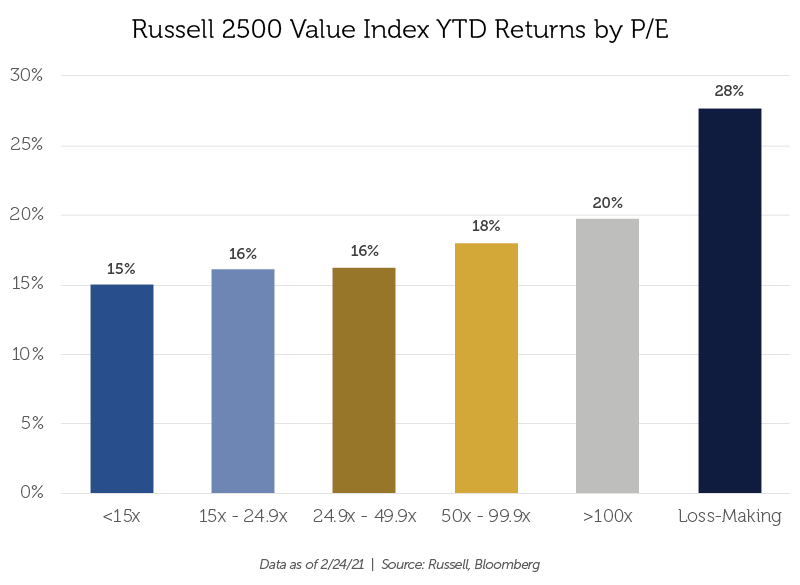

Also astonishing is how shares of these unprofitable companies have been on a tear thus far in 2021.

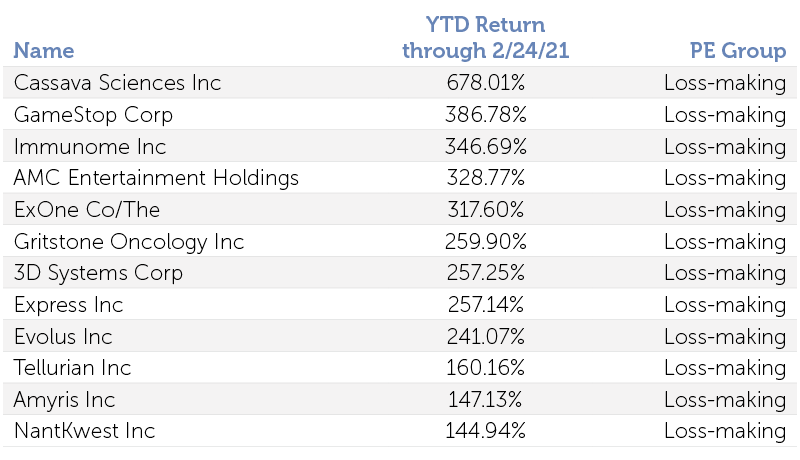

From the start of the year through 2/24/21, within the Russell 2500 Value Index, stocks with P/E ratios over 100x or those generating losses have returned 20% and 28%, respectively, as illustrated by the above chart. In fact, all of the top-performing stocks in the Index fall into the “Loss-making” category. Check out the returns of the top-performing 12 stocks:

Does this resemble a value index to you? Loss-making companies may be able to continue their outperformance as long as the low interest rate environment persists, but if inflation becomes more of a concern and the Federal Reserve begins to raise rates, the cost of capital and ability to access credit markets will become more of an issue for these money-losing companies, many of which are already heavily indebted.