- While the U.S. consumer remains resilient, and spending continues at fairly robust levels, there are underlying signs of consumers pulling back.

- In the third quarter, some retailers reported customers trading down to private label brands or smaller pack sizes.

- Banks and other companies with finance arms noted credit trends are beginning to “normalize” from ultra-low levels aided by pandemic-related stimulus.

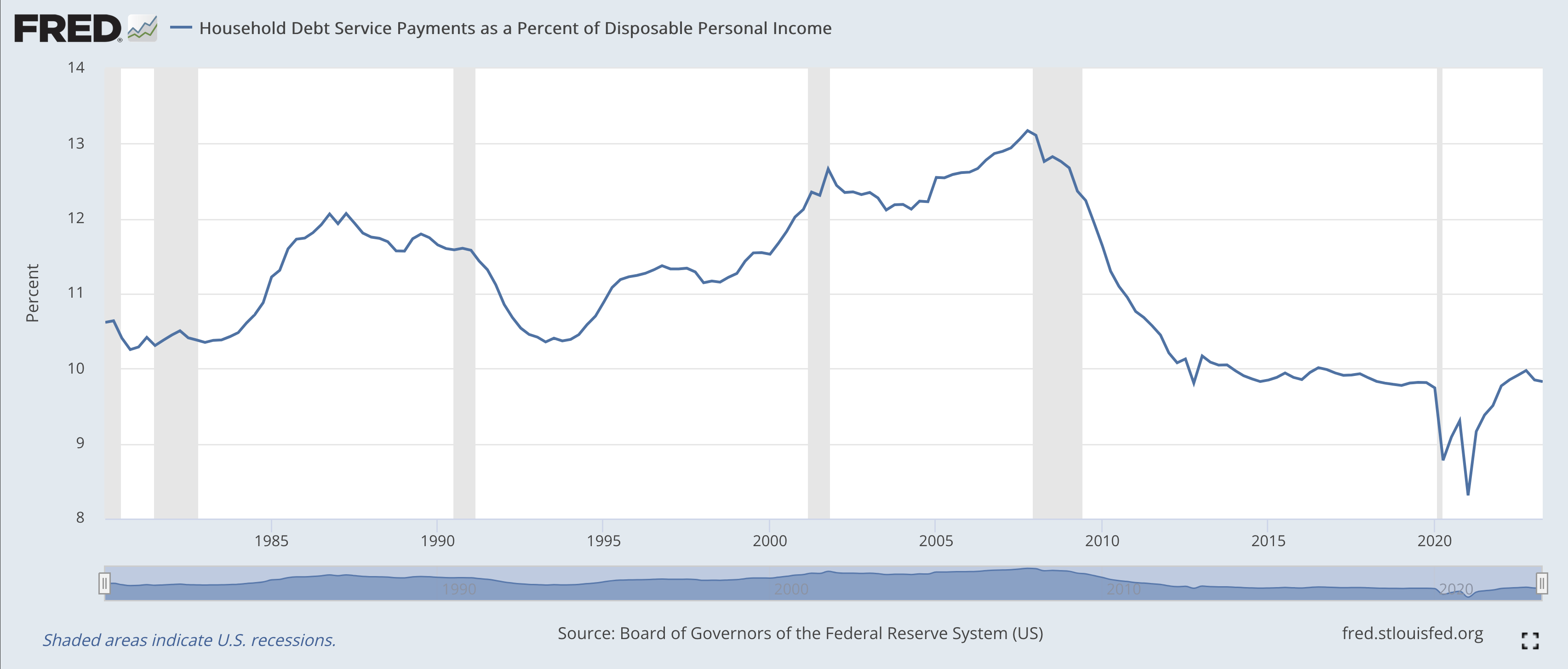

- Meanwhile, consumer balance sheets continue to be relatively healthy, and, as this chart shows, overall debt service payments, for the time being, remain historically low.

- We believe higher inflation and interest rates may persist, but do not see a recession in the near term.

- Following years of lower interest rates helping to drive ever-higher growth-stock valuations, we think value investing is ripe for a period of outperformance.