“I am a Tariff Man.” – President Donald J. Trump (December 4, 2018)

Current Market Environment

While the first quarter of 2019 ended with a sense of optimism that trade negotiations were going well with China, the second quarter was a roller coaster of renewed tensions with Beijing, plus new threats against Mexico (in May, President Trump promised to impose tariffs on Mexico if the country didn’t do more to stem illegal immigration into the U.S.). Even though the White House announced a 180-day reprieve for slapping tariffs on EU and Japanese autos, the potential for trade disruptions here looms large.

These threats served to add further economic uncertainty, and, while the Fed left interest rates unchanged during their June meeting, the central bank has grown increasingly dovish. Indeed, in his June testimony, Chairman Powell indicated that, “Apparent progress on trade turned to greater uncertainty, and our contacts in business and agriculture report heightened concerns over trade developments. These concerns may have contributed to the drop in business confidence in some recent surveys and may have started to show through to incoming data…While the baseline outlook remains favorable, the question is whether these uncertainties will continue to weigh on the outlook and thus call for additional monetary policy accommodation.”

Given this backdrop, and the now high probability of rate cuts in the near term, the bond market rallied during the second quarter and the 10-year Treasury once again dipped below 2.0%. And, while the S&P 500 continued its march higher, the Atlanta Fed’s estimates for 2Q GDP are for 1.4% growth as compared to 1Q19’s 3.1% growth.

One of the more useful axioms on equity investing is “Don’t fight the Fed.” So the inflection point shift to a dovish stance that started in the fourth quarter 2018 market selloff has reignited the bull market for stocks.

Market Outlook

After a ten-year post-financial crisis period of consistent underlying conditions for equity investing, fundamentals are shifting. Modestly slowing economic growth and macro concerns have given investors pause and led to a rerating of certain risk assets. Regardless, the U.S. economy remains fundamentally healthy and continues to be a global leader.

Interest and mortgage rates continue near historically low levels, having retraced by over 120 basis points from the October highs as inflation remains benign and economic growth moderates. Although we are clearly late in the economic cycle, the odds of a 2019 recession without a full-blown trade war seem low.

Investment-grade corporations have decent balance sheets and are currently producing acceptable free cash flows. We are carefully monitoring aggregate corporate debt levels (especially the BBB- debt which is a single notch above junk status), which now sit above pre-2008 crisis levels. The 2018 corporate tax cuts and the ability to repatriate foreign cash holdings should continue to drive higher employment, M&A activity, and capital returns including buybacks and dividends. Profit margins remain near all-time high levels, currently 11%, and look to be at some risk from higher wages and input costs.

In our estimation, equity valuations have quickly bounced back to elevated levels. During the last four months of 2018, we moved to the seventh decile from the tenth decile on trailing operating earnings only to rebound back to the ninth decile.

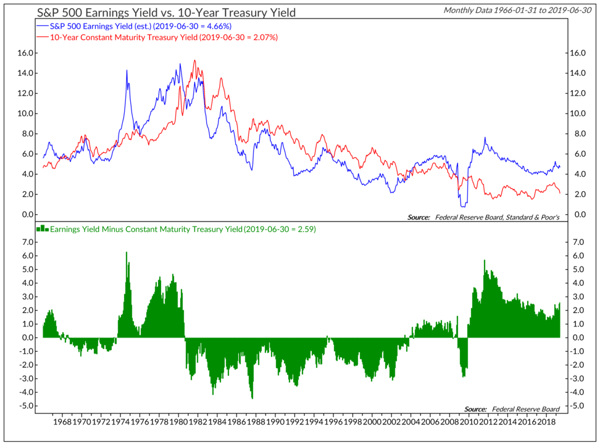

Equities look most reasonable when comparing earnings yields to Treasury or even high-grade corporate bond yields. In any case, the values inherent in the portfolios we manage should attract acquirers and other investors over time. Meanwhile, we believe equities are a superior asset allocation alternative to bonds over the longer term.

Copyright 2019 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved.

Copyright 2019 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved.

See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/.

At Prospector, we remain committed to making our investors money while protecting their wealth.